On average, gold prices rise during the first two months of the year and then fall during the spring and summer before rising again in the fall. If you want to buy before the price of gold increases, it is best to start now. The cost of gold is determined by supply and demand. There are many ways to invest in gold, such as buying physical gold in the form of jewelry, ingots, and coins; investing in a gold mining company or other gold-related investment; or buying something that derives its value from gold.

Each method has its own advantages and disadvantages, which can make it difficult for first-time investors to decide which option is best for them. Those who choose to invest in gold through options or futures contracts must actively monitor their holdings in order to sell, renew, or exercise their options before they expire. Investing in physical gold can be a challenge for those who are more used to trading stocks and bonds online. The information provided here is for general informational and educational purposes only and should not be taken as financial or investment advice. Investing in gold is not without risks and may not always offer a positive return.

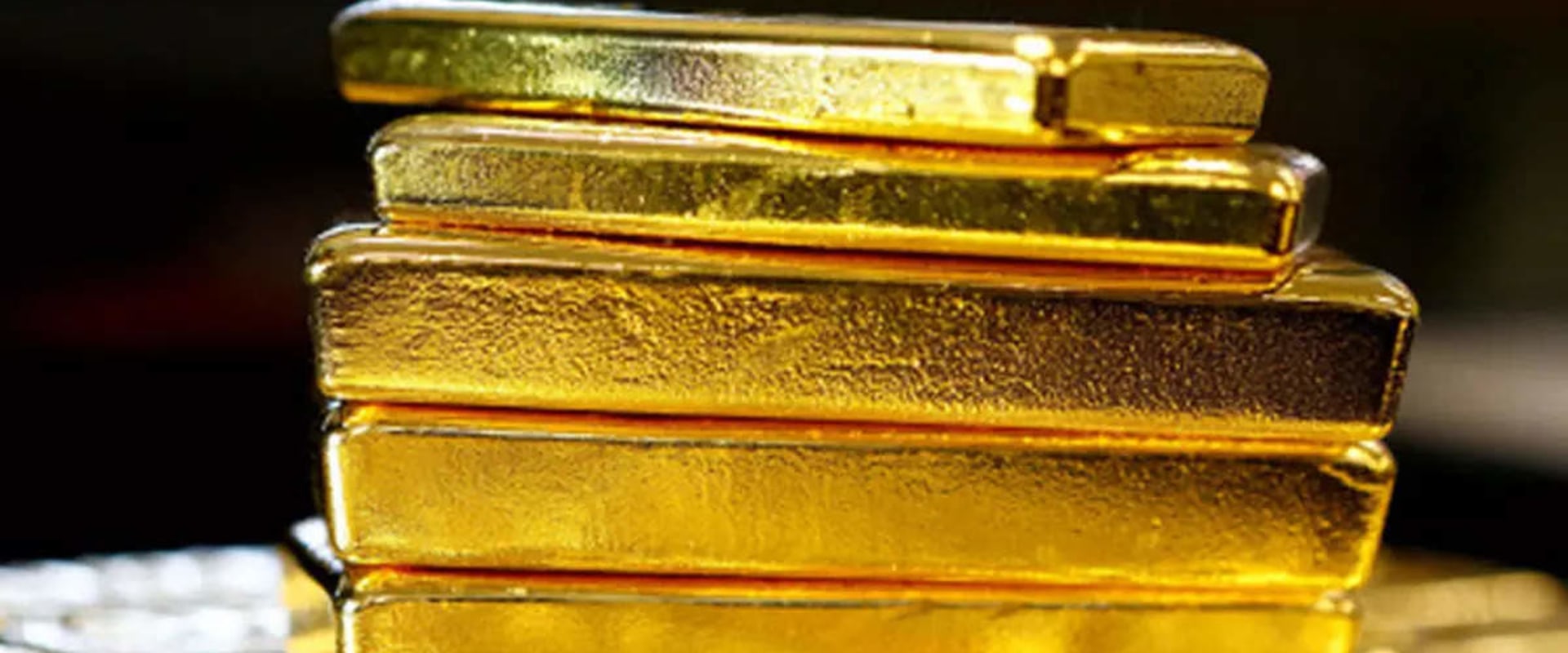

If you think gold could be a safe bet against inflation, then investing in coins, bullion, or jewelry is the path you can take to gold-based prosperity. Investment decisions should be based on an assessment of your personal financial situation, your needs, your risk tolerance, and your investment objectives. Bullion is what most people think of when they consider investing in gold - big, shiny bars locked away in a vault. These are some of the main benefits of gold, but investing, like all investments, is not without risks and drawbacks. Throughout history, few investments have matched the popularity of gold as a hedge against inflation, economic turmoil, currency fluctuations, and war.

Ultimately, the decision to invest in gold will depend on your individual circumstances and market prospects. Gold mutual funds are actively managed by professional investors. Gold is often considered a good investment for diversification as it may be less correlated with other assets such as stocks or bonds. Any estimate based on past performance does not guarantee future performance and before making any investment you should analyze your specific investment needs or seek advice from a qualified professional. The biggest advantage of using futures to invest in gold is the immense amount of leverage you can use. However, it is important to remember that this form of speculative investment carries more risk than other methods.